Faced with the worst pandemic in a century, the federal government has promised trillions in 2020 to prevent a second Great Depression – more in inflation-adjusted dollars than was spent during the New Deal.

How can journalists gauge the economic impact and the effectiveness of the $5 trillion federal response?

In sessions for the National Press Foundation, Maya MacGuineas, president of the Committee for a Responsible Federal Budget, gave a big-picture overview of COVID-19 stimulus programs, the effects on the national debt and the deficit, and tools for how to track all that money.

The first coronavirus stimulus programs were passed by Congress in the frenzied weeks after businesses, schools and most aspects of public life shut down in March 2020. The biggest legislative package – the CARES Act – included very visible programs such as the $1,200 checks most U.S. adults received and the Paycheck Protection Program intended to help small businesses.

MacGuineas spoke to National Press Foundation fellow programs in July and September, keeping them up to date on the massive pot of COVID stimulus money.

In all, according to MacGuineas’ organization, Congress has enacted five pieces of legislation to boost the economy. As a share of gross domestic product, the total is about the same size as the economic stimulus passed in the wake of the Great Recession of 2007-09. This time, however, the money is going out the door much more quickly.

The funds involve administrative actions such as delaying tax deadlines, congressionally funded programs and support for the Federal Reserve. Taken together, more than $11 trillion in administrative, congressional and Fed support could be spent. As of September 2020, about $5 trillion has been.

That spending compounds existing U.S. debt, which now totals about $25 trillion. Although MacGuineas is no fan of taking on more debt, she said now is the time to do so to prevent economic collapse.

“We are in the midst of a huge moment when you should be borrowing,” she said. But, she added, it’s a reminder of why the nation shouldn’t have been borrowing so much when the economy was growing.

The nation’s debt as a share of the economy is now about 100% — higher than at any time since the end of World War II. But the economy is in a drastically different place than it was emerging from a war; it will be much more difficult for the nation to climb out of this debt hole, she said.

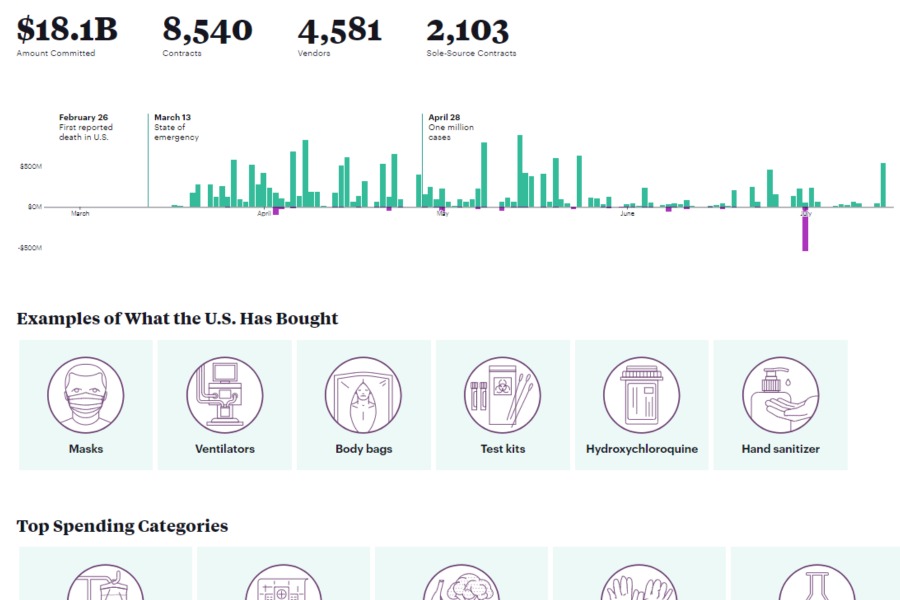

The Committee for a Responsible Federal Budget’s COVID Money Tracker allows users to drill into specific programs, by industry or type of support (loan, grant, tax change). It also shows how much of the money has actually gone out the door and what effect it has had on the budget deficit.

This program is funded by the Evelyn Y. Davis Foundation. NPF is solely responsible for the content.